There Is No Free Market in America

Editor’s Note: I’d like to share an article with you from Gold World‘s sister publication Wealth Daily which was featured last week. The article was written by Angel Publishing founder and New York Times Best-Selling Author Brian Hicks. Brian is one of the only writers around who is brave enough to tell the truth about the deception of free markets in America. This is one that you don’t want to miss.

Sincerely,

Greg McCoach

Editor, Gold World

————-

The Democrats and liberals among Wealth Daily‘s readership aren’t going to like this article.

That’s because I’m about to dispel a longstanding belief among partisan Democrats. . . especially among the more naive.

And that is that the Democrats weren’t a willing party to the current economic crisis. (Don’t worry. . . George W. and the neocons are responsible for the trillions spent in the never-ending whatever that is in Iraq and Afghanistan, but I’ll save that argument for another day.)

Here’s the proof. . .

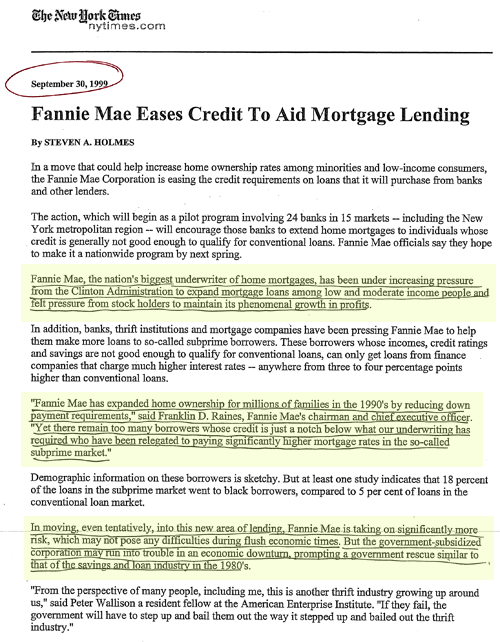

This is an article from the New York Times dated September 30, 1999. . .

How does that make you feel???

Now, you’re constantly hearing spin in the media and from politicians about how the current economic situation is a result of "free market failure."

Nothing could be farther from the truth.

Let me state for the record. . . THERE IS NO FREE MARKET IN AMERICA.

The market in the U.S. is heavily regulated and manipulated.

The housing bubble was the result of a massive government stimulus plan. Right after 9/11, the U.S. Treasury and U.S. Federal Reserve cut rates to historic lows and increased money supply to obscene levels.

Couple that with the push for more home ownership. . . and what you get is a toxic brew of government-sponsored economic activity.

As Ron Paul has said thousands of times (and he’s been vindicated 1000x over), the free market would never have let rates drop as low as they did after 9/11.

You see, one of the primary components of a healthy, functioning free market is risk.

Risk is necessary to weed out bad and irrational actors.

When you start handing out what is essentially free money and allowing borrowers to take out mortgages with $0 down, you eliminate risk. And when that happens, you’re indicating there’s no consequence of action.

That’s why so many homeowners are so willing to walk away from their homes: because they have no skin in the game. They lose nothing if they allow their home to go into foreclosure.

Had these same homeowners put 10% down, I guarantee they’d be less willing to walk away from that investment.

But trying to explain that to a socialist is like trying to tell somebody from Philly that Brooks Robinson was the greatest third baseman in history. It’s an argument with no ending.

Profitably yours,

Brian Hicks

Publisher, Wealth Daily

P.S. Uncle Sam’s massive construction of debt over the past several years virtually guarantees inflationary pressure and the continuing decline in value of the U.S. dollar. And now that the greenback has had some strength, there’s never been a better time to go short on the U.S. dollar. Luke Burgess has recently added the two leveraged U.S. dollar short investment positions to his 2009 Secret Stock Files Investment Strategy Portfolio. And he wants to share them with you today, so you too can protect your future financial well-being and profit from the continuing decline of the U.S. dollar. If you’re interested in learning more about these two investment vehicles, just click here.