Record High Gold Prices

Welcome to Gold World’s new weekend review. Each week we’ll take a look at the week that was and what’s ahead, along with what you may have missed from our free sister sites, Energy and Capital, Wealth Daily, and our free blogs. Enjoy.

———

Before we jump into new record highs for gold prices, and why it may go higher, I wanted to bring your attention to Bear Stearns. Methinks they pulled a "Countrywide move."

It was 2007 when Countrywide Financial (CFC) had us believing that it had ample capital and liquidity to stay in business. They disclosed $35.4 billion in reliable liquidity. And they disclosed "sufficient liquidity available to meet projected operating and growth needs and significant accumulated contingent liquidity in response to evolving market conditions."

But who were they fooling? They burned through the $2 billion Bank of America cash infusion, burned through the $11.5 billion credit line used to ease liquidity issues. They burned through Fed cash infusions. And they burned through that $50 billion cushion they said they had.

They said they had ample capital and liquidity in August 2007 when they stated, "Our mortgage company has significant short-term funding liquidity cushions and is supplemented by the ample liquidity sources of our bank. In fact, we have almost $50 billion of highly reliable short-term funding liquidity available as a cushion today. It is important to note that the company has experienced no disruption in financing its ongoing daily operations, including placement of commercial paper."

Seven days later, the company announced that it faced "unprecedented disruptions" in debt and mortgage markets.

Now, take a look at what Bear Stearns did.

On March 12, Bear Stearns’ CEO appeared on CNBC and said (per Briefing.com) their "liquidity position has not changed and their balance sheet has not weakened at all. Says their liquidity cushion has not changed. Don’t see any pressure on their liquidity, let alone a liquidity crisis. As they close the books, they are comfortable with the range estimates that are out there currently."

He even denied threats to liquidity and said the company had a $17 billion cushion. Investors actually cheered the news and sent BSC up.

Too bad the rumors were true. Good news for the gold bugs.

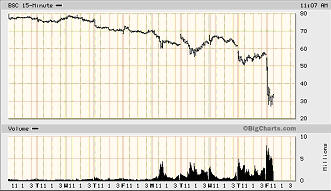

Here’s a ten-day chart of Bear Stearns. Notice the "sucker’s rally" on Tuesday.

Price of Gold Nails $1,005.50

Early Friday, spot gold skyrocketed to $1,005.50 from Thursday’s $991.00, and is seen racing higher on financial hardship and our "falling knife" dollar.

That’s after Bear Stearns shares fell 50% on news that its liquidity position had deteriorated so badly in 24 hours that it was forced to secure financing from JP Morgan Chase and the Federal Reserve of New York.

For gold bulls, the news couldn’t be better. The announcements by Bear Stearns and further market negativity are likely to send gold much higher . . . possibly to $1,200 when all is said and done, thanks to a falling dollar. As we write, the euro is trading at an all-time high of $1.5657, surpassing a previous peak of $1.5625.

What’s interesting is that the Bear Stearns announcement comes a day after the S&P said the end was near for the credit crisis, news that helped major indices close in the green.

It all makes you wonder what color the sky is for credit agencies.

"We’re past the halfway mark," says S&P . . . but they’re wrong.

Standard & Poor’s believes that subprime write-downs will total close to $285 billion when the crisis is over, putting us "past the halfway mark."

But the S&P has as much credibility as Tom Cruise has as a psychiatrist.

Say reports, "Standard & Poor’s Ratings Services believes that the bulk of the write-downs of subprime securities may be behind the banks and brokers that have already announced their results for full-year 2007. There may be some additional marks to market as market indicators have shown deterioration in the first quarter. However, when we dissect the percentage of write-downs taken against various types of exposures, in our opinion the magnitude of some write-downs is greater than any reasonable estimate of ultimate losses . . ."

Unfortunately, the financial world is nowhere near the end of crisis. At Countrywide and Washington Mutual, for example, option ARMs are only now beginning to reset. These are a type of ARM with as many as four monthly payment options with interest rates that can change every month.

Business Week says, "A closer look at the books of big lenders reveals several weak spots that haven’t yet shown up in the financial results. At many banks, bad loans are piling up faster than the amount of money they’re setting aside to cover them. Meanwhile, housing lenders booked income on vulnerable exotic loans and mortgage securities before they collected the money–paper gains that may be reversed through write-downs. Plus the values of some troubled loans, which have been trimmed modestly so far and shown up in previous losses, could still be overstated.

"Lenders, most of which report first-quarter profits in April, will probably realize more pain as auditors and analysts scrutinize balance sheets. That could touch off another round of banks scurrying for capital or cash from outside sources to shore up their businesses. ‘Every day there’s a new revelation, an "Oh, by the way, I forgot to tell you about this other problem,"’ says Donn Vickrey, co-founder of Gradient Analytics, a Scottsdale (Ariz.) research firm specializing in forensic accounting."

Oh, and don’t forget about prime write-downs and the continuing waves of delinquencies and foreclosures, which soared nearly 60% in February. According to reports, 223,651 U.S. homes received "at least one notice from lenders last month related to overdue payments, up 59.8 percent from 139,922 a year earlier."

It’s time to pull your head out of the sand and wake up, S&P. We’re nowhere near finished.

———

For the week of March 10, 2008, here’s what we covered in Gold World and elsewhere.

Energy Storage Stocks: The Lucrative Play No One’s Talking About

A UK-based company is placing its bet on the storage of energy in hydrogen. It is developing an electrolyzer that uses solar or wind power to split water into hydrogen and oxygen. The hydrogen is then pressurized and stored for use in electricity production or for powering cars.

Rising Oil Prices: How Can You Protect Your Investments from Surging Oil Prices?

Remember when people felt oil was too expensive at $60 a barrel? How about when it reached $80 a barrel? Now ask yourself, "How will I feel about $109.72 per barrel when prices hit $120 a barrel this summer?"

Libyan Oil: One Country’s $109 Profit on $110 Oil

In February, $85 to $90 sounded like an agreeable oil price to Shokri Ghanem. Then in early March the head of Libya’s national oil company declared that his country had "no complaint" with $100 per barrel. Now we’re pushing $110, and Libya’s big-mouth momentum is building with each dollar.

$1,000 Gold: Gold Hits $1,000 an Ounce

At last look, gold for April delivery spiked to an all-time nominal high of $1000.80 an ounce. The precious yellow metal has gained about 18% so far this year after tacking on nearly 32% during 2007, says Luke Burgess.

Ben Bernanke to the Rescue: Homebuilders Bounce . . . for Now

Ben Bernanke strikes again. And for the homebuilders, his $200 billion injection into the financial markets was the equivalent of manna from heaven: more money thrown at a mortgage market in crisis. All of them rallied sharply in the wake of the latest cash dump courtesy of the Federal Reserve. But that deluge of dollars managed to completely overshadow more troublesome news from the downtrodden industry.

Health Sector Stocks: Anavex: Under-the-Radar Stock up 39%

It was November 30, 2007, when Brian Hicks introduced you to Anavex (AVXL:OTCBB) as it traded at a paltry $3.75. "If it is able to execute its business plan, even a small investment in this stock is going to be an absolute home run," said Brian. "Seven of their drug discoveries are currently working their way through the approval process after very promising early trials."

American Express Stock: Only the Naive Are Investing Long on American Express

The Bernanke Fed move is a temporary band-aid. It turned a 24-hour lending window into a 28-day lending window. That $200 billion banking blood transfusion was placed to ensure that your checks clear. That’s how bad the banking world is. You don’t want to hold the American Express, Bear Stearns, Citigroup, or even Bank of America.

The Chinese Market Bubble: What a Chinese Death Cross Means for Your Portfolio

It’s known to technicians everywhere as a death cross, and it is happening on the Shanghai Composite Index. That’s the index that has jumped by over 450% during the last two years–a sure sign of a speculative bubble. A death cross is formed when the 50-day moving average of a stock falls below (crosses) the 200-day moving average. It indicates that there are currently more people selling than buying the stock. It is as bearish as it gets.

105% gains in 16 trading days: Take It.

While we remain bullish on natural gas and our United States Natural Gas (UNG) stock, we’re recommending that you exit the second half of the UNG April 2008 43 calls (UNGDQ). In no way does this move reflect bearishness on our part . . .

Bear Stearns pulls a "Countrywide"?: Too Bad the Rumors were True…

It was 2007 when Countrywide Financial (CFC) had us believing that it had ample capital and liquidity to stay in business. They disclosed $35.4 billion in reliable liquidity. And they disclosed "sufficient liquidity available to meet projected operating and growth needs and significant accumulated contingent liquidity in response to evolving market conditions."

Oil Will Pay for the Iraq War?: Where $52 Billion Worth of Oil Is Disappearing Per Year

Last year alone, says Bryce, the American forces in Iraq burned through more than 1.1 billion gallons of fuel.

That’s it for this week. For more, visit your free EnergyandCapital.com, GoldWorld.com, and WealthDaily.com.

Have a great weekend,

Ian L. Cooper