One Last Hurrah for the US Dollar

Over the past few years the U.S. government has abolished countless freedoms of the American people… all in the name of "national security."

They’ve spent trillions of tax dollars – forced upon citizens under penalty of imprisonment – on an imperialistic military to fight an un-winnable war on terror, while all but neglecting our growing domestic problems.

The government and CONgress protects big business to create a symbiotic business/government relationship giving supreme power to the corporate elite.

And to top it all off, they’ve controlled mass media (notwithstanding the internet) to put a lid on the truth.

But don’t worry. They’re looking out for your best interests.

One Small Step for Elitists, One Giant Leap for Fascism

Unless you’ve been living under a rock for the past few weeks, you’ve heard the U.S. government has now nationalized the entire mortgage industry with the acquisition of Freddie Mac and Fannie Mae. And now, it hopes to siphon $700 billion from American taxpayers to buy up the bad debt of financial institutions for the next two years.

Now, take a second or two… and think about how much $700 billion really is. It’s seven hundred thousand million dollars! $700,000,000,000.00

Another perspective: It’s enough to give every man, woman, and child in the city of Philadelphia a half-million dollars.

Listen… that $700 billion figure represents about 5.2% of the entire U.S. gross domestic product in 2007.

If approved, the bailout would raise the statutory limit on the national debt 6.6%… from $10.6 trillion to $11.3 trillion.

And what will U.S. taxpayers like you and I get in return?

Nothing. Zip. Zilch. Nada.

- There are no plans for new regulations or oversights to help avoid this kind of crisis in the future.

- There’ll be no public interest givebacks to help the people whose homes are in the hands of the banks.

- And, perhaps most shockingly of all, we will get absolutely no share in the profits if these fallen-from-grace financial giants bounce back… even though we are now assuming a great deal of the risk.

This is worse than a bad deal for us. In fact, it isn’t even a deal!

The new rescue plan may restore a bit of investor confidence to battered financial markets. But investors will again begin to focus on the twin budget and current-account deficits and negative real U.S. interest rates. And eventually the government’s plan will derail the dollar’s three-month rally, which is, in effect…

The One Last Hurrah for the U.S. Dollar

The greenback has already started to retract. The U.S. Dollar Index, a measure of the value of the U.S. dollar relative to a basket of six foreign currencies, has pullback as much as 5.6% in the past two weeks.

Gold prices have certainly enjoyed the descending dollar. Gold has recently broken several daily movement records, including a $90.40, 11.6% one-day increase the other day. As a result, gold and gold mining stocks are starting to come back to life.

In fact, numerous stocks in the Mining Speculator portfolio have made big moves… and show no signs of slowing down. Take a look…

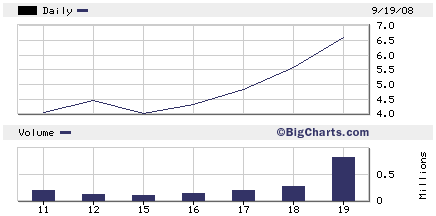

One stock in the MS portfolio has increased 75%… in just 7 days:

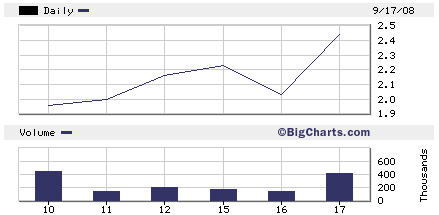

Another of our mining plays soared 134% in only 6 days:

Two other Mining Speculator stocks jumped a whopping 80% and 57% in just 3 days.

It’s just the beginning of a massive upward movement we’ll see in the coming weeks and months.

Mind you, while gold prices have rebounded strongly, many gold stocks have yet to follow suit… most likely due to false hopes the U.S. dollar will be able to survive.

What does it all mean?

It’s simple. There’s simply never been a better time to be vested in gold stocks. The sub-prime meltdown, the housing market crash, and the coming catastrophic decline of the greenback have enabled this tremendous profit opportunity.

Fortunately, there’s an easy way to get your share of these most-certain profits…

The Mining Speculator Portfolio: An Average Gain of 212% Over 5 Straight Years

And it’s about to get even better…

We’re on the verge of a breakout run in junior gold and mining stocks. And it’s not uncommon for junior mining companies to experience huge gains (tenfold or more) very quickly as news of a discovery leaks out.

On top of that, the evolving bull market in precious metals not only focuses more attention on the sector, but also causes even more money to be spent on exploration. And the payback for a new find increases exponentially.

There’s simply no stopping gold from doubling up and hitting $2,000 an ounce. Dollar destruction will ensure the yellow metal’s meteoric run.

Now I’ve been preaching gold’s profit potential for much of the last decade. And, truth be told, few people paid much attention when I first began making investment recommendations in the mining sector.

Still, those who did listen have made extraordinary returns. They bought when the news concerning the mining sector was negative. Even now, few are paying any attention to the mining sector and are still being lured by the Wall Street hype and disinformation to invest in blue chips and the general stock market.

Worse, many investors are being lured by a sudden glut of gold "experts" claiming inside knowledge of gold, silver and the broader precious metals markets.

Don’t believe ’em. The true experts – the ones who can deliver gains most people can only dream about – can be counted on less than two hands. I should know – I’m one of them.

That’s why now, more than ever, I’m recommending every investor have some exposure in junior mineral stocks.

And there’s an easy way to do just that… for as little as $25.

To get immediate inside access to the junior mining companies poised for major run-ups – the ones I’ve visited firsthand and carefully selected after exhaustive research and quality controls – simply take a trial of my Mining Speculator advisory. This $25 investment could make you a fortune within the next few months.

Simply click here to get started.

Good investing,

Greg McCoach

Investment Director, Mining Speculator

Editor, Gold World