Invest in Gold

The market gods are about to present us with a more than generous gold buying opportunity. Will you take it?

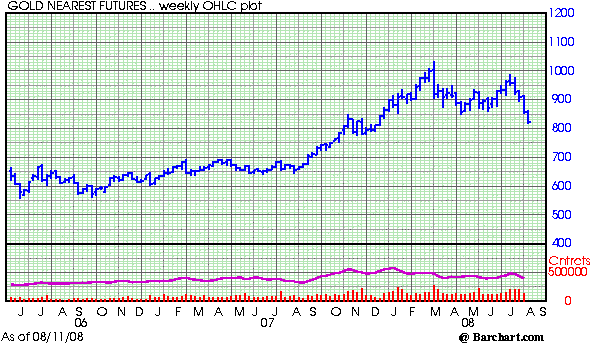

Gold prices fell sharply again today extending their losses from last week as a decline in oil prices and strength in the US dollar put downward pressure on the yellow metal. And we’re coming to the perfect time to invest in gold for new speculators.

Gold for October delivery plummeted almost $40 during intraday trading today, bottoming out at US$820.50/oz and closing the day at US$828.50 an ounce.

For over three and half weeks gold prices have consistently pulled back. And there’s no doubt that the gold bull has stalled, at least for now. But the fact is, this stall was expected.

Back during the great gold bull market of the 1970s gold prices shed roughly 40% for almost two years between 1975 and 1977 before the mania stage pushed prices a staggering 750% higher.

At that time—and as it is today—we heard most of the mainstream analysts sounding the gold bull’s death knell. But the smart money went against the grain. And they profited like never before. Now it’s your turn to invest in gold and be the smart money.

Oil prices are headed further south as demand weakens and the US dollar will continue to bounce back against other currencies in the short to mid-term. This will continue to lead the major funds away from gold, and other commodities including silver, depressing prices further. But, this will also create the perfect opportunity to re-establish a position in gold.

Investing in Gold: The Gold Bull Is Far From Over!

Despite weakness in prices, global gold demand is growing faster than supply. Over the past several years we’ve seen a massive influx of capital flowing into the exploration and development of gold properties. Nevertheless, overall world gold production continues to drop. In fact, global gold mine production was at an eleven-year low last year. And total production costs were up by US$99/oz.

The fundamentals of supply and demand are enough to push gold prices significantly higher. But the real kicker is going to be the massive growth in money supply and the poison fruit of unsecured debt.

Howard Ruff, the legendary author and financial advisor, put it nice and bluntly in a short commentary a few days ago:

| With government unfunded liabilities (for Social Security, Medicare and Medicaid) more than $50-trillion, and no end in sight, and government doing its ostrich act (head in the sand) hoping the pain will just go away, and their standard practice of just throwing money at every intractable problem, we have set the stage for continuing soaring inflation. I am doing a lot of radio talk show interviews, and the hosts keep asking me "what proof do you have of future inflation?" My answer? "Haven’t you been to the grocery store lately, or bought any gas? It’s here now; the proof is all around you." |

I expect gold prices to continue dropping in the short to mid-term. And I urge you to take advantage of this opportunity to get back into gold investing. Be the smart money this time around.

Good Investing,

Luke Burgess

Editor, Gold World