IMF Gold Sales

Yet US bigwigs, such as George Bush and Ben Bernanke, remain reluctant in admitting that the American economic slump means that the country is in recession. The fence-sitting Fed Chairman told Senator Charles Schumer at a joint hearing on the US economic outlook:

A recession is possible. But a recession is a technical term defined by the National Bureau of Economic Research depending on data which will be available quite a while from now, so I am not yet ready to say whether or not the US economy will face such a situation.

Typical.

Meanwhile, former Fed Chairman Alan Greenspan came out on CNBC today saying that the US economy is in fact "in the throes of recession" stating a significant decline in consumer spending.

Over the past few weeks we’ve seen a media-fueled firestorm of debate across both sides of the argument coming from economists and analysts spanning all sectors.

But debate and rhetoric don’t solve problems.

And whether the US is or is not in a recession, there’s no doubt that we’re headed for stormy weather. I think everyone would agree with that. So what we really need is action to promote the healthy growth of the economy. Not debate and rhetoric. And really we need to be prepared or anything.

The Department of Labor reported last week initial US jobless claims surged 38,000 to a seasonally adjusted 407,000 in the week ending March 29 from an upwardly revised 369,000 in the prior week. Initial jobless claims now are flirting with recessionary levels. Historically, jobless claims spike above 400,000 when the US economy enters a recession.

In the midst of all this, a AAA survey showed today that average gasoline prices in the US hit another all-time high of $3.343 a gallon, up nearly 20% from what they were last year, and banks continue to drop like flies. Even the Federal Reserve’s bank is having problems.

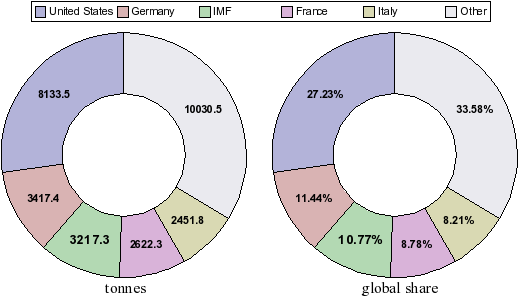

The International Monetary Fund, which recently said that there is a 25% chance of a world recession, has approved a decision to start selling a portion of its massive gold hoard (the third-largest in the world) to offset part of an anticipated $400 million deficit in its own $1 billion budget this year. The IMF, which holds 3,217 tonnes of gold (worth about $92 billion now), said that it was hoping to sell up to 400 tonnes of gold to raise money in a time when the organization was struggling with cash flow.

Central Bank and Supranational Organizations Gold Reserves

The International Monetary Fund monitors nation’s economic and financial developments and offers advice and technical expertise to help developing economies stabilize their exchange rate and re-structure government finances to get out of crisis.

Using the $338 billion or so in cash that it holds, the IMF also acts, in essence, as a central bank for central banks lending money to countries with balance of payments difficulties to provide temporary financing and to support policies aimed at correcting the underlying problems. And like any other bank, the IMF earns it keep by charging interest on these short-term loans.

However, since the Argentine crisis of 2001, which was blamed on the IMF’s advised policies, new IMF lending, the source of its income, has shrunk dramatically. The world’s developing economies have simply developed too fast and they don’t need so many hand-outs from the IMF. So to buoy the lack of interest-related income, the IMF has decided to sell some of its gold reserve, which has more than tripled in value in the past seven years.

Many are speculating that the IMF gold sales will drastically push gold prices lower and by extension help the US dollar recover. But this tactic has been tried before with little success.

Between 1976 and 1980, the IMF sold a third of its bullion (a massive 1,600 tonnes) in a bid "to reduce the role of gold in the international monetary system". Half of those sales were given to member nation at $35 an ounce, the old fixed price until the US dollar was cut free of gold in 1971. Interestingly, over the five years of the IMF’s sales, average gold market prices were over five times higher. The other half of that IMF gold was sold via auction. But the auctions were so well subscribed, the impact of these sales actually forced gold prices higher.

The actual effect of these gold sales on market prices is left to be seen. But overall, I believe investors need not be very worried about the continued growth in gold prices.

The US economy is now running a trade deficit worth 6.5% of its annual turnover (economists get nervous about any figure above 3%), the government has run up $9 trillion in debt, and the dollar has shed a third of its value in the last five years to reach all-time record lows against the rest of the world’s currencies. I remain very bullish on gold as the future of the US dollar, and overall US economy, is cloudy at best.

Until next time,

Luke Burgess

www.GoldWorld.com

Editor’s Note: Despite a significant pullback, gold has already returned significant gains for investors. The greenback is still near all-time lows against many world currencies, resulting in a 20% gain in gold for the year. Gold is still hot. But silver is even hotter! Find out why I think silver prices could rise to over $150 an ounce!