There’s a familiar rhythm to every real bull market…

Prices surge, confidence builds, and then — right when the trade feels obvious — the market pauses.

That pause is all it takes for Wall Street to declare the move “over,” for commentators to start calling tops, and for impatient money to rotate out.

And that’s exactly what’s happening in gold right now…

After a historic run, gold has taken a breather. Not collapsed. Not broken. Just paused.

And suddenly we’re being told the rally is exhausted, the upside is gone, and lower prices are inevitable.

That story sounds convincing — until you look at the numbers that actually matter.

Because when you do, the bearish case doesn’t just weaken. It completely falls apart.

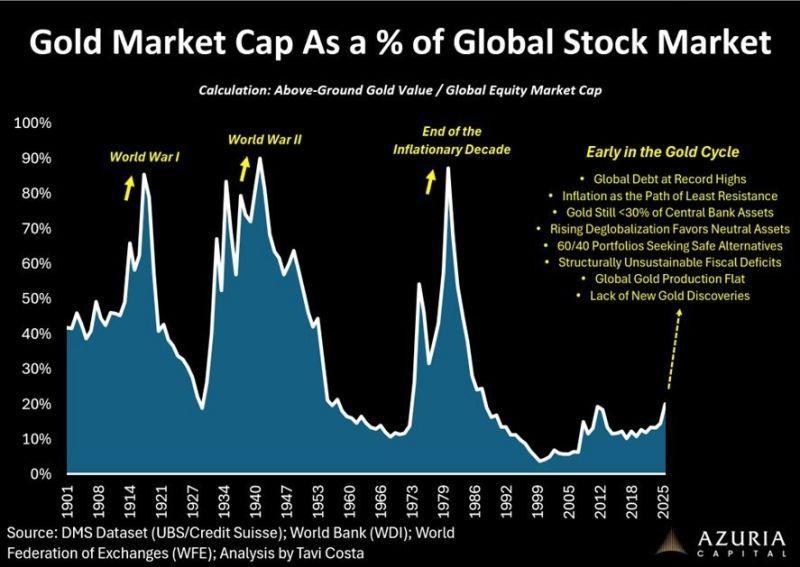

Gold Isn’t Expensive — Global Stocks Are Bloated

If gold were truly “too expensive,” you’d expect it to dominate the financial landscape. You’d expect it to be sucking oxygen out of global markets.

Instead, it’s still barely registering…

At current prices, the total value of all the gold ever mined on Earth comes in around $15–16 trillion.

That’s every central bank reserve, every bullion bar, every coin, every ounce of jewelry.

Now put that next to global equities…

Worldwide stock markets have ballooned past $110 trillion.

Depending on how you count derivatives and cross-listed assets, the number gets even larger.

Either way, the conclusion is unavoidable: gold represents roughly 13–14% of the value of global equities.

That’s not excess. That’s underexposure.

At the peak of the last great gold bull market in 1980, gold’s market capitalization reached roughly 85-90% of global equities.

Gold didn’t need to become dominant — stocks simply lost their monopoly on investor confidence.

If gold were to only return to that historical relationship — not exceed it, not enter a speculative frenzy — today’s prices would look laughably low in hindsight.

This rally didn’t run out of room. It barely left the driveway.

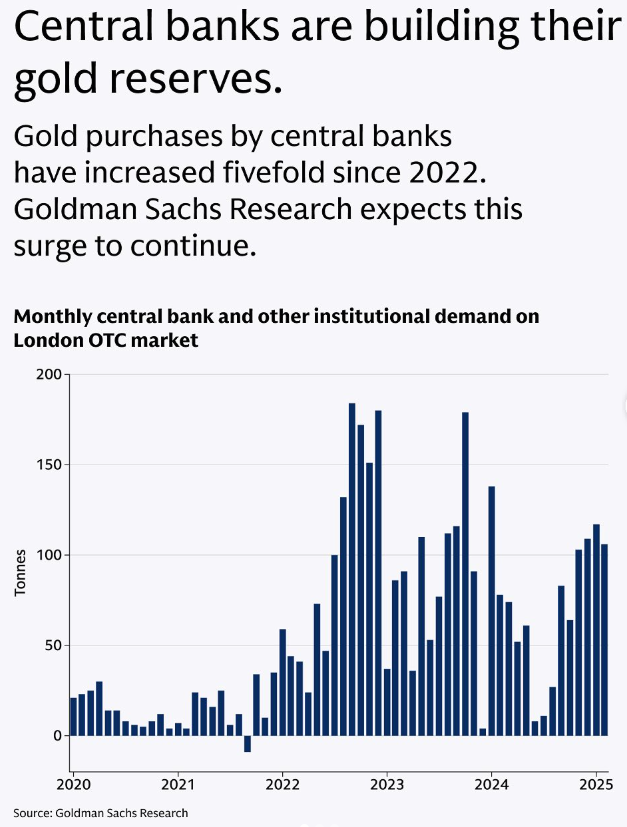

Wall Street Owns Stocks. Central Banks Own Gold. Pay Attention.

Another problem with the “gold is over” narrative is who’s actually buying.

Central banks have been accumulating gold at the fastest pace in modern history.

They bought more than 1,000 metric tons in 2022, followed by another 1,000+ tons in 2023 — a pace far above the long-term average. And they’ve only accelerated since…

This isn’t momentum trading. Central banks don’t chase performance.

They buy gold when confidence in paper assets, political systems, and reserve currencies erodes.

Sanctions, frozen reserves, weaponized payment systems, and exploding sovereign debt have changed the rules…

Gold is once again being treated as neutral collateral — an asset outside alliances, outside politics, and outside counterparty risk.

And, again, there is no sign this buying is slowing.

When the most conservative capital on Earth is still accumulating, calling a top isn’t brave.

It’s reckless… Maybe even stupid.

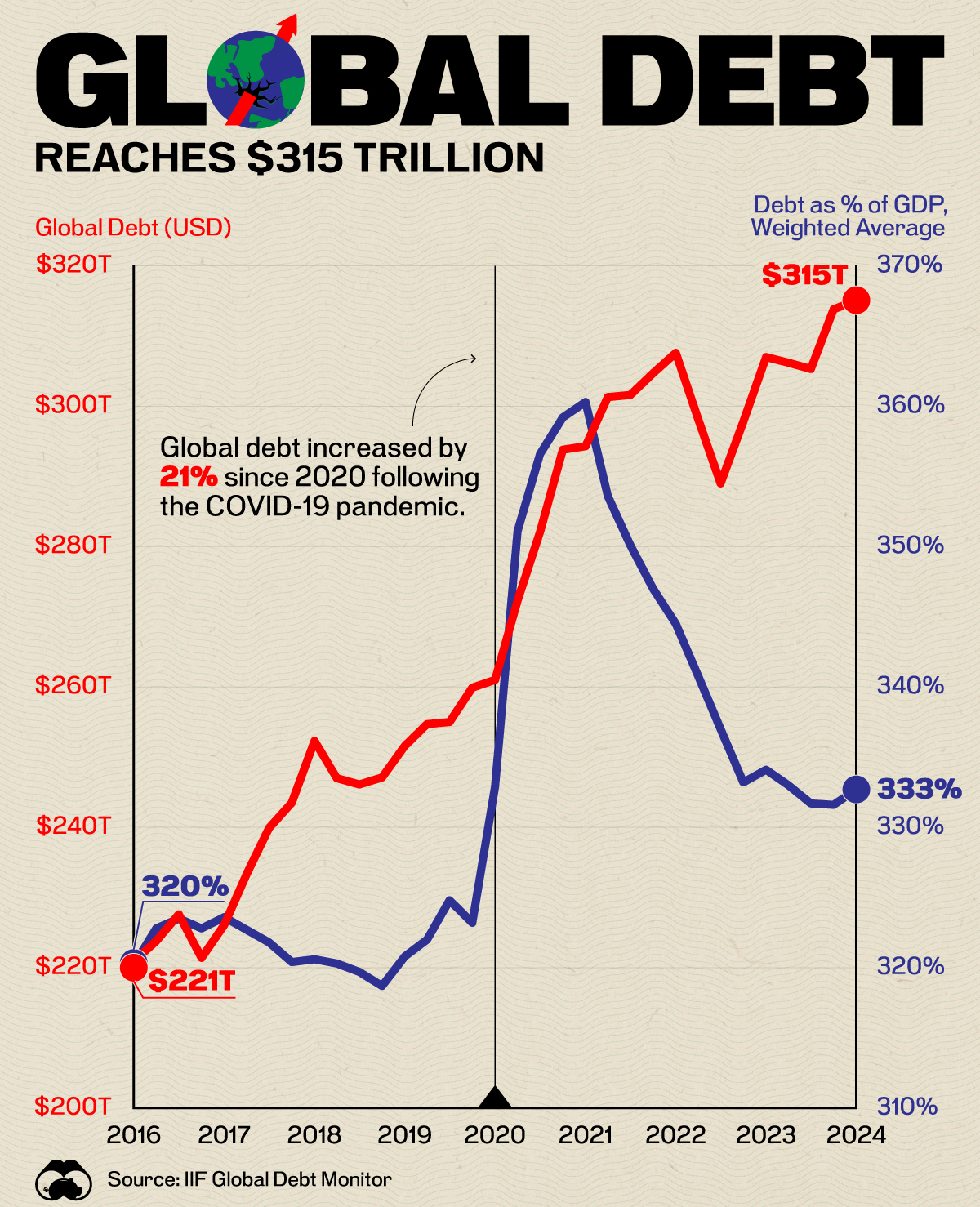

$300 Trillion in Debt Makes Gold Look Small — Not Dangerous

Global debt has now surged past $300 trillion…

Governments are running deficits that would’ve triggered emergency summits a generation ago — and they’re doing it during periods of supposed economic stability.

Interest expense is becoming unmanageable. Fiscal discipline has vanished.

Every attempt to normalize policy ends the same way: economic stress, political backlash, and a return to accommodation.

This is not a cycle. It’s a structure.

And gold’s entire market cap — that $15–16 trillion — sits next to this debt mountain like a footnote. A rounding error.

If gold is insurance against monetary excess, then it is still wildly under-owned relative to the size of the risk it’s insuring.

Geopolitics Didn’t Calm Down — They Calcified

The idea that geopolitical risk is “priced in” would be funny if it weren’t so dangerous.

Russia’s war with Ukraine continues to reshape energy, food, and defense markets.

China hasn’t abandoned Taiwan — it’s simply patient.

Iran remains a destabilizing force across the Middle East, threatening shipping lanes, energy infrastructure, and regional stability.

At the same time, supply chains remain fragile, and critical minerals are openly being used as bargaining chips in trade and diplomacy.

This is the opposite of the stable, cooperative world that once justified extreme confidence in financial assets.

Historically, this is exactly the environment where gold reasserts its monetary role — and where its share of global wealth expands dramatically.

This Is Where NatGold Changes the Conversation

Here’s where things get even more interesting — and where the gold market is about to evolve in a way Wall Street is not prepared for…

For decades, gold ownership has been constrained by friction: storage, transport, trust, liquidity, and accessibility.

Those frictions kept gold under-allocated, even as its relevance grew.

That’s what NatGold aims to disrupt.

NatGold introduces a new way to gain exposure to gold — not through paper claims or complex derivatives, but through tokenized ownership of verified, in-ground gold resources, backed 1:1 by independently estimated reserves under NI 43-101 or JORC standards.

In other words, NatGold doesn’t just make gold digital. It makes gold investable at scale.

When gold exposure becomes easier to access, easier to transfer, and easier to integrate into modern portfolios, the market cap math changes fast…

You don’t need speculation. You just need allocation.

Even a small reallocation of global capital — from bloated equity markets into gold and gold-backed digital assets — would have an outsized impact on prices because the gold market is still so small relative to global financial assets.

NatGold doesn’t replace physical gold or miners. It amplifies the entire ecosystem.

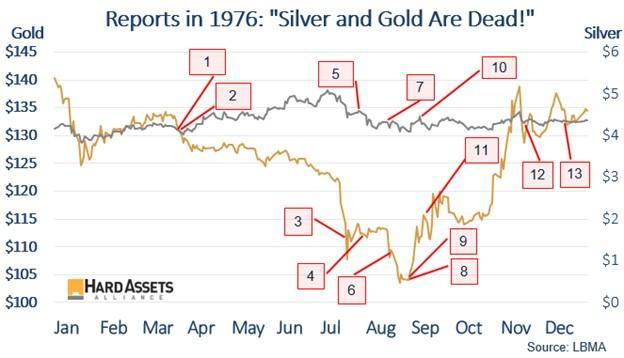

Corrections Don’t End Bull Markets — They Set Traps

Every secular gold bull market includes moments like this…

Periods where prices pause, sentiment sours, and commentators rush to call the top — right before the next leg higher begins.

The 1970s gold bull market was full of violent pullbacks that convinced observers the rally was over.

Each time, gold regrouped and surged to new highs as the structural forces asserted themselves.

Today’s pause looks eerily familiar.

Gold hasn’t failed. It’s consolidating while the disparity between gold and global equities remains extreme.

This Isn’t the End — It’s the Setup

The consensus says gold peaked.

The data says gold is still a fraction of global financial wealth.

Central banks say they still want more.

Governments say they’re not done borrowing.

Geopolitics say instability is the new baseline.

And NatGold says the gold market is about to become more accessible — and more relevant — than ever before.

Gold didn’t top.

Wall Street just blinked.

And when reality reasserts itself, the gap between gold and global equities won’t stay this wide.

It never does.

To owning what’s real,

Jason Williams

Senior Investment Strategist, Gold World