Gold and The U.S. Dollar

Spot gold prices shed over $45 on Tuesday falling below $800 an ounce for the first time in almost three weeks. Today’s drop in gold prices follow a broader sell-off in commodities as a weaker-than-feared Tropical Depression Gustav undermined oil prices, which fell by as much as $10 a barrel, and the US dollar continued an upward trend.

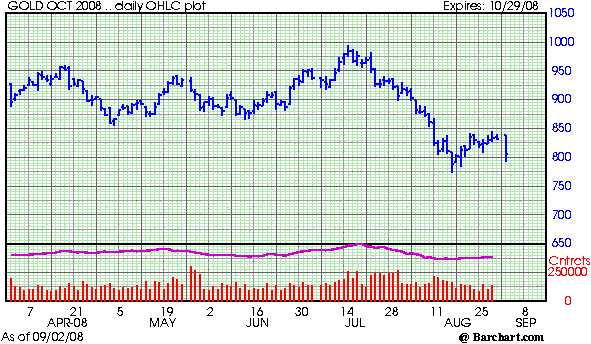

Gold for October delivery plummeted $46.50, or 5.5%, to a intraday low of $791.60 an ounce on the Chicago Board of Trade. Meanwhile, the benchmark crude-oil contract tumbled as much as $10 to $105.46 a barrel, the lowest in five months.

Gold lost $89.20 in August, the biggest monthly loss in dollar terms since at least 1984. Conversely, the US dollar has strongly rebounded over the past several weeks. The US Dollar Index, a measure of the greenback against a trade-weighted basket of six major currencies, has moved 9.5% higher since mid-July.

There’s no doubt that investors are starting to get scared. But the fact is that the gold and metals market bull is still completely intact. Gold has already been through two of the three major stages of a bull market. The last—the mania stage—is yet to be realized. Once this mania stage kicks in, we believe that gold prices will easily top $2,000 an ounce. In the meantime we just have to be patient.

One the key indicators that we’ll be watching over the next several weeks is, of course, the US dollar. Despite the recent rebound, the greenback still has all of the problems it had over the past several years, which has eroded its value nearly 50% since 2001. And there’s little doubt in our minds that the US dollar is in a complete death spiral. Once people start to realize the true value of the US dollar, which is almost nil, gold will be the most logical haven.

For the short-term, however, we can expect lower gold prices. Downward momentum will likely push spot gold prices lower for the next six months, maybe even longer. So there’s still plenty of time for investors to get their ducks in line. Nonetheless, we believe that owning physical gold will be the most important investment in the next few years. We continue to recommend to buy gold on strong weaknesses.

Spot gold prices closed today down $24.90, or 3.8%, to $806.30 per ounce.

Gold World Staff