Don’t own gold yet? Don’t worry…

Because even at $940 an ounce, gold prices are still positioned to surge by three… four… or even five times!

In fact, if gold prices perform even half as well as they did during the bull market of the 1970s, the yellow metal will explode to over $2,500 in a matter of months.

The world’s top gold consultant agrees…

GFMS Ltd. (formerly known as Gold Fields Mineral Services) recently echoed Gold World’s longstanding rationale for higher gold prices and predicted a new price record within the next few weeks.

GFMS Executive Chairman Philip Klapwijk wrote in a recent report, “Looking at the second half of 2009, investment demand, and especially its western elements, which includes activity in ETFs, futures and the OTC market, is expected to remain the driving force behind gold price movements.”

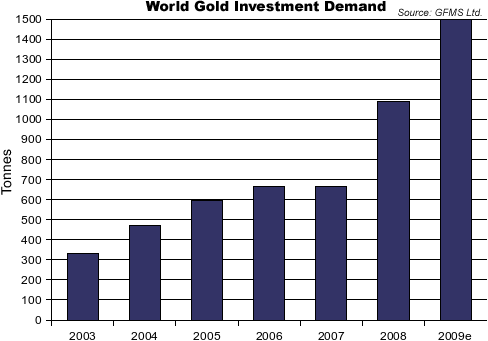

The independent consultancy group, which pulls information from over 15,000 contacts across 49 countries around the world, predicted that identifiable gold investment will exceed 1,500 tonnes by the end of this year. This estimate would represent a significant 36% increase over identifiable gold investment demand in 2008.

In dollar terms, GMFS expects gold investment demand to increase 57% over last year to nearly $50 billion.

As a result of this surge in investment demand, GFMS expects gold prices to break through the nominal high of $1,032 an ounce, which was set back in Spring 2008.

GFMS reported that global gold demand will experience a massive increase this year, particularly from net investment and official coins components as a result of rising fears over the long-term inflation threat in western nations. This is the same idea proposed to readers of Gold World over the past several years.

Investment demand has been one of the main reason for the rally in gold that has taken the precious metal from around $250 in early 2001 to around $940 today.

Total identifiable gold investment during the first quarter of this year totaled 595.9 tonnes, a historical high and increase of 248% compared to the first quarter of 2008. In dollar terms, this represented a net inflow of $17.4 billion, up from $5.1 billion (or 42%) a year earlier. Investment demand figures for the second quarter of 2009 won’t be out for a few more weeks.

At the same time, silver prices are expected to outperform gold for the same reason.

In the latest quarterly report, GFMS pointed out that investment demand accounted for only 50 tonnes in 2008. However, silver investment demand was quite strong in the first quarter as investors mobbed the metal as a cheaper alternative to gold.

Silver investment demand is anticipated to be such that it could account for between one quarter and one fifth of total consumption in 2009. Meanwhile, silver supply is expected to decline this year, with mine output, scrap and government sales all softening.

The investment shift from paper assets to precious metals will continue pushing prices higher and eventually skyrocket prices into the classic parabolic spike. We continue to urge all Gold World readers to buy and hold both gold and silver in anticipation of significantly higher precious metal prices.

Good Investing,

Luke Burgess

Managing Editor, Gold World

Investment Director, Hard Money Millionaire

P.S. With a gold resource worth 63 times more than its market cap, this junior gold stock is getting ready to pay off big time. This tiny $0.34 stock could make it’s first move over $2.00 in short order. The whole story is laid out for you here.