$1,000 Gold

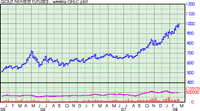

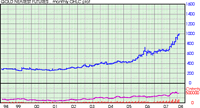

Forward-month gold prices just topped the $1,000-an-ounce level as a weakening US dollar spurred demand for the precious metal as an alternative asset and hedge against inflation.

At last look, gold for April delivery spiked to an all-time nominal high of $1000.80 an ounce. The precious yellow metal has gained about 18% so far this year, after tacking on nearly 32% during 2007.

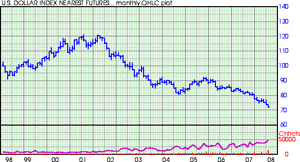

Steep losses in the US dollar continue to be the main driver of gold’s ongoing bull market. The ailing US currency dropped to an all-time low against the euro prompted by speculation about further interest rate cuts from the Federal Reserve.

Lower interest rates tend to weaken the dollar and prompt investors to move into hard assets like gold, which is known for holding its value in times of rising inflation and during political, social and economic uncertainty.

A series of Fed cuts beat the dollar down last year and contributed to a 10% loss against the euro in 2007. Recent speculation about further Fed cuts has pushed the 15-nation European currency to as high as $1.5627 against the greenback today, its loftiest level since the euro began trading in January 1999.

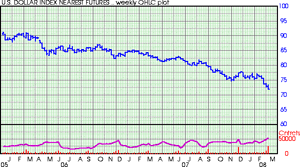

For a broader understanding of the dollar’s value we look to the US Dollar Index, which measures the performance of the US dollar against a basket of six currencies: euro (57.6%), Japanese yen (13.6%), British pound (11.9%), Canadian dollar (9.1%), Swedish krona (4.2%) and Swiss franc (3.6%).

The USD Index also saw an all-time low today, falling to as low as 72.21 as both the yen and Swiss franc also marched to record highs against the dollar.

So far this year the USD Index has shed 5.5%, after losing 9% in 2007. Since its high in the summer of 2001, the USD Index has lost 40.5%

You can expect further losses in the dollar as confidence in the US economy diminishes and fears of a long-term recession solidify.

The $1,000 level for gold is just the beginning. A panicky market could easily shoot gold prices to over $2,000 an ounce.

Luke Burgess

www.GoldWorld.com